TOOL Spawn in Women & DEIB • 1 yr. ago

Funding Female Founders: Exploring the Gender Gap

Today, around 13% of all startup founders across sectors are women, the lowest since 2018. Women make up appr. 30% of Western European start-up founders, many in mixed-founder teams. The proportion of startups worldwide with a female co-founder doubled from 10% up to 20% between 2009-2019, and up to 28% for the US.

For us working in the even more male dominated ocean & energy industries, we have identified 3 key issues we need to tackle jointly to change the current landscape.

We need to 1) create increased awareness and access to quality-based, compiled insights on the current imbalance - we need to 2) showcase the business case of funding female-led companies - and we need to 3) find and apply practical hacks to improve this. Plus, of course - make it easier for everyone to find relevant founders, which is why we´ve started mapping & listing female founders under the 500 Female Founders of Ocean & New Energy initiative.

Funding the Future

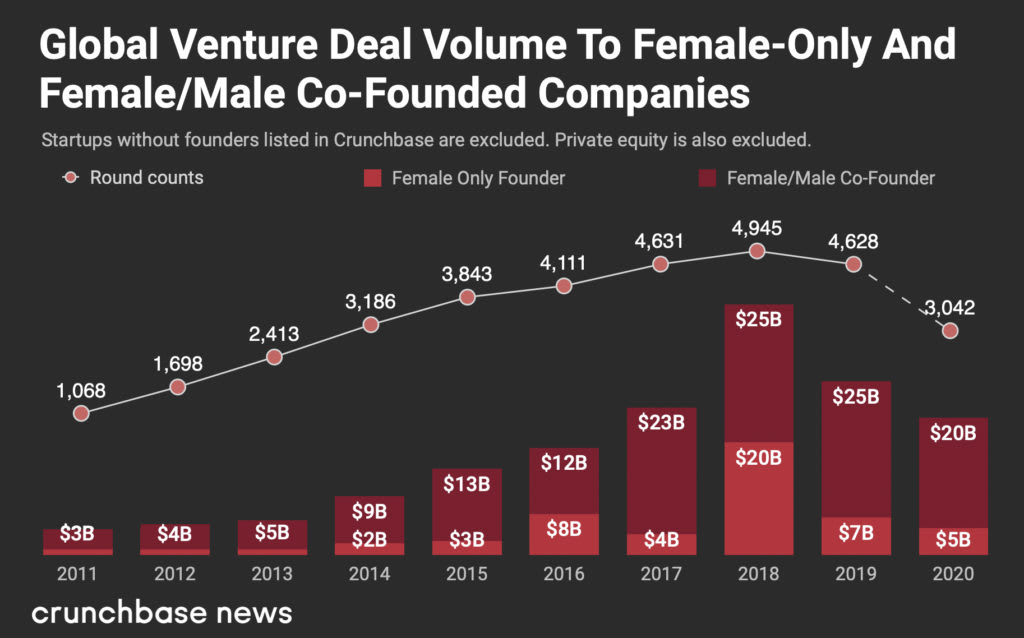

Over several years less than 1% of European risk capital and 2,4% of US risk capital has flown towards all-female founders, and they get less than half the VC deal size compared to male peers. Only 3% of worldwide VC went to women-led startups in 2019, then down to 2% in 2020.

However, even though we are extremely far from creating an inclusive future built on a representative part of the population, there is some positive movement in the markets.

Let´s start by looking at some key stats on current funding status. Yup, they´re shocking, but as we don´t let frustration or status quo stop us - we also compiled some much cooler facts and insights on the untapped business opportunities - as multiple reports shows how women-lead companies outperform male peers.

The funding gap - current stats & highlights

Statista´s female-founded startups global report shows that the ratio of female-founded and female-lead startups is growing, but still limited to a small fraction of startups worldwide.

Survival of early stage is critically depending on capital, hence the gender financing gap on debt and equity financing - where only 12% reach teams with at least 1 female founder - is vital.

More than half of female founders in tech reported gender discrimination while fundraising, 40% by potential investors.

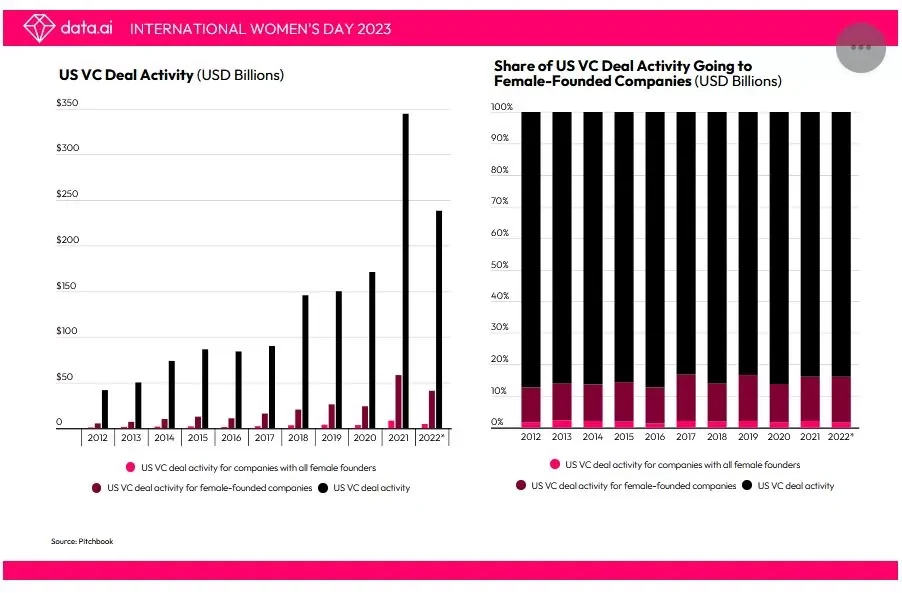

US: While women now account for 40% of new US entrepreneurs, up untill 2022 less than 2% of VC funding reached women-founded companies, the lowest level since 2016/2012.

However, while the overall capital raised in the US in 2023 declined, mixed-gender and women founded teams in the US raised 23% of all VC capital in total. Money-wise, this represented $34,5 billion, down from $61,5 billion raised in 2021.

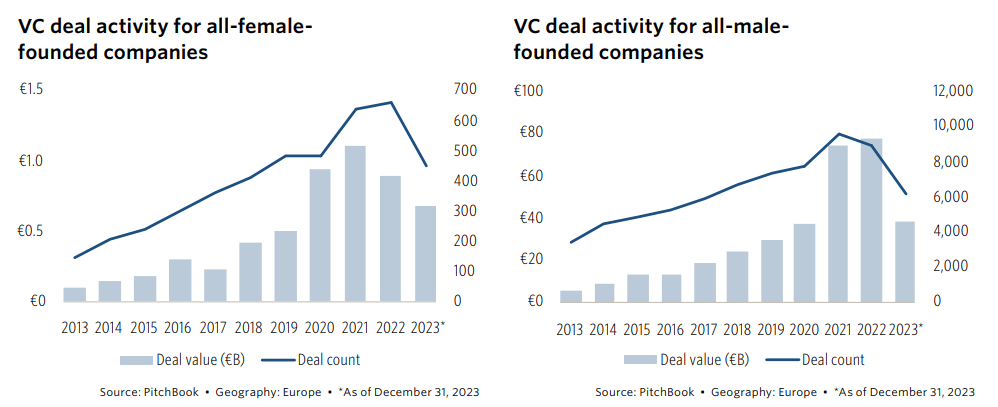

In Europe, startups founded solely by women raised just 1,8% of capital invested in venture-backed startups. When including mixed-gender teams, these secured 9,6% of total VC funding, according to Dealroom. However, in mixed teams, women tend to own a lower portion of shares than male peers.

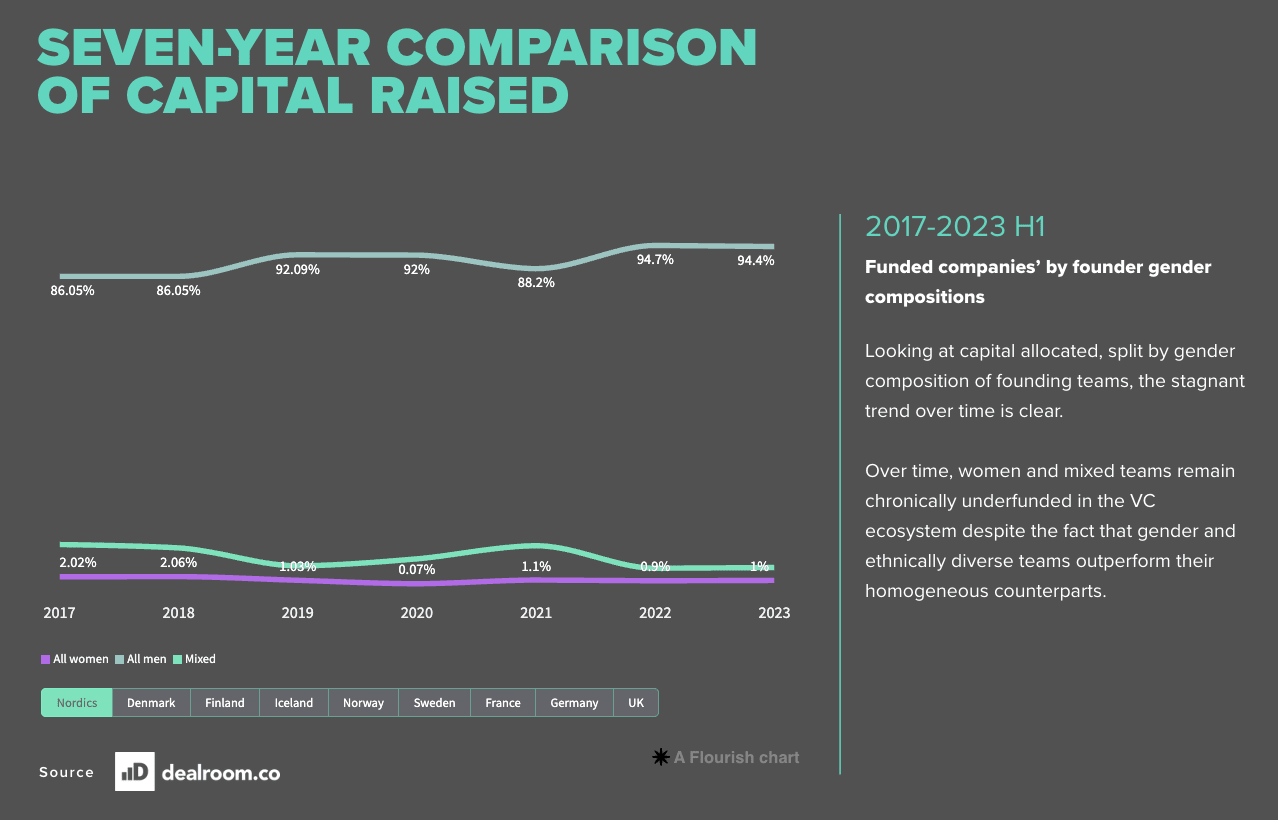

Deals for European female-founded companies grew more than twice as fast as deals for all-male-founded companies over the past decade. The share of VC investment raised by women over the last decade has doubled, but since 2017 this number has stalled.

On the positive note, 40% of European VCs now spend more time seeking investment opportunities into female-founded companies, according to Female Foundry´s State of Gender Diversity Report.

PitchBook Female Founders report find that European female founders broke 2 funding records in 2023: The percentage representation of total deal value (20,5%) and deal count (25,8%).

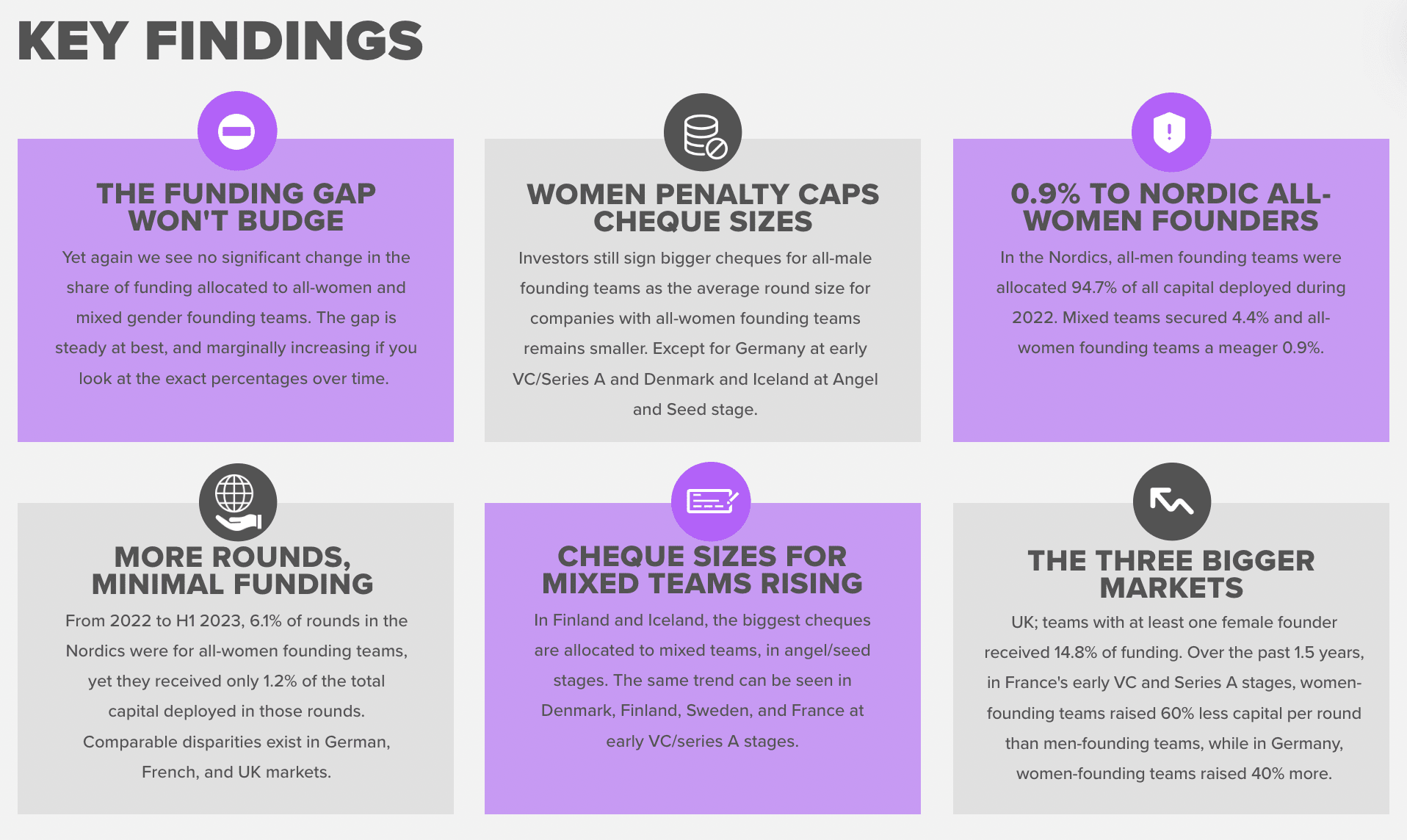

NORDICS: While many talk about the need for funding diverse founders, talk isn´t turned into real action. Even in the Nordics - supposedly the most equal corner of the world - only 0,9% of all VC capital deployed in 2022 landed with all-female founder teams. Mixed teams secured 4,4%, while all-male teams got 94,7%. And the funding gap isn´t really improving, through the 7 years that Unconventional Ventures have sourced data and published their annual Nordic report...

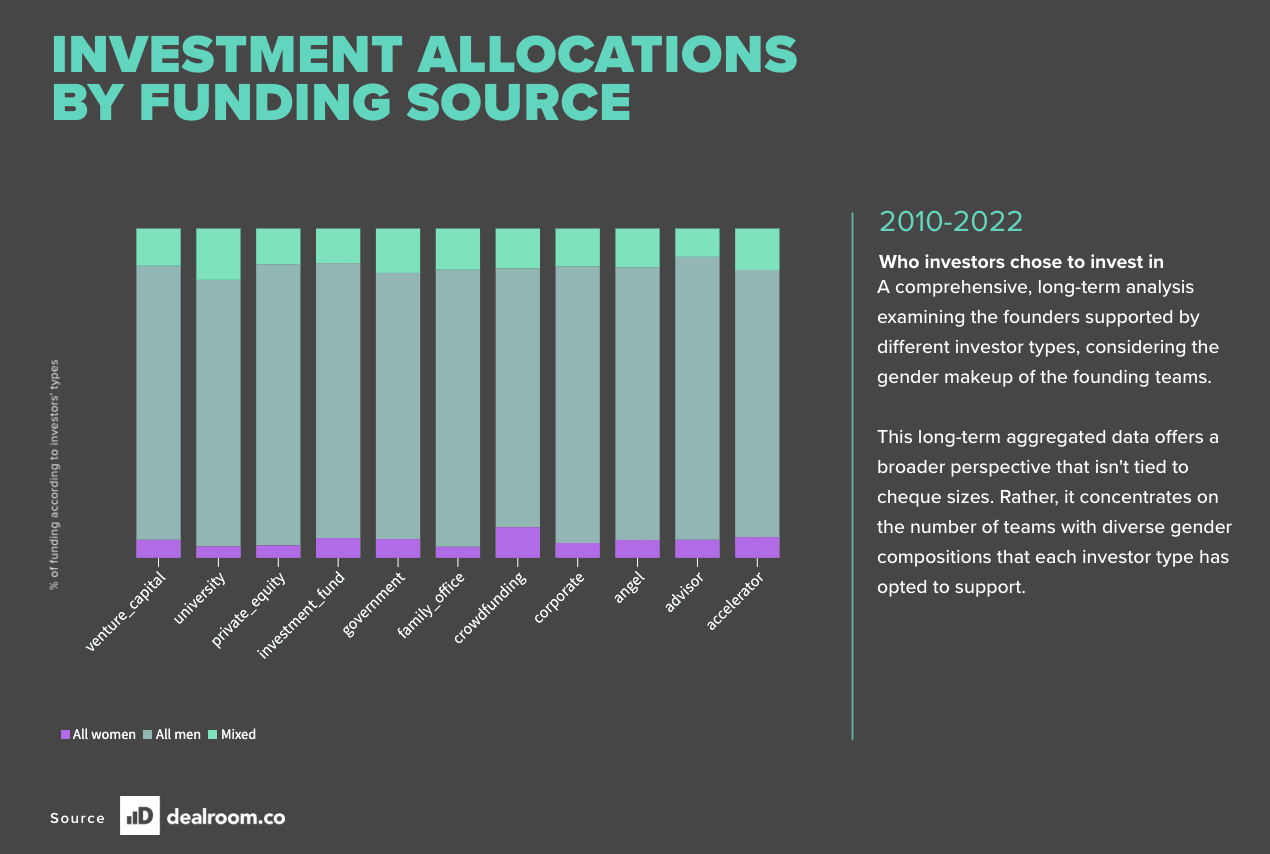

When we expand and look at more diverse funding sources, including public grants, family offices, accelerators a.o., all-women teams still get only up to 3,5-6% of the funding, except for crowdfunding (9,5%).

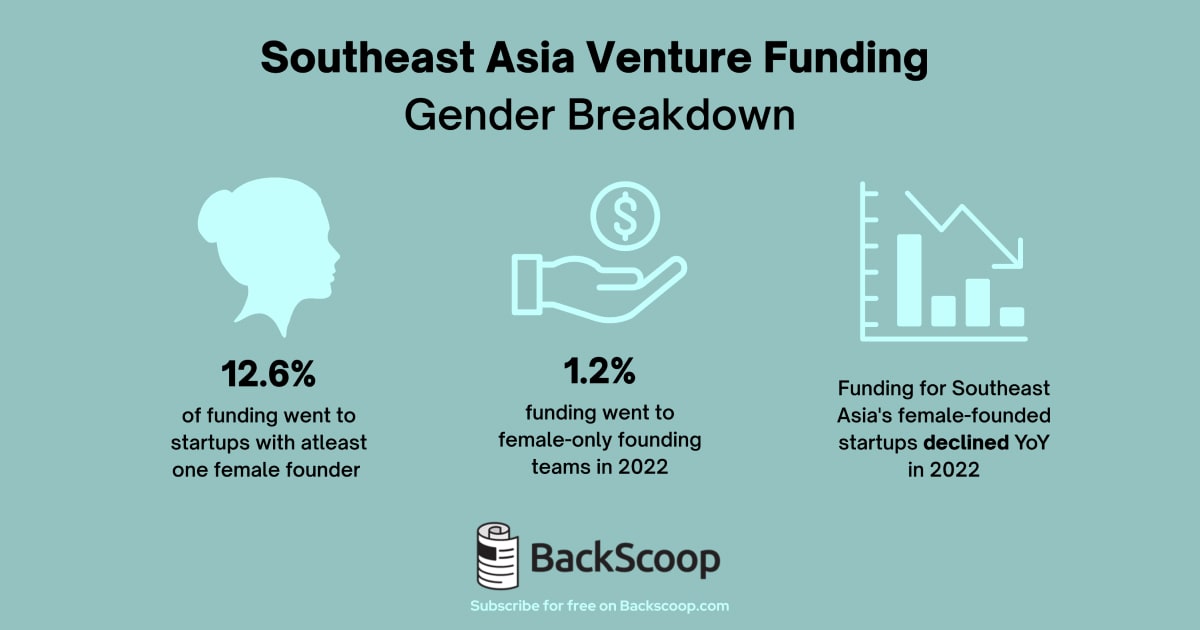

ASIA: According to Deal Street Asia, only 1,2% of the VC funding went to female-only companies, but up to 12,6% when we include mixed teams. While Pitchbook´s 2021 report on South East Asia states that only 0.6% of funding went to all-female founded teams, while 16.4% went to teams with at least one female founder.

In India*, only 0.3% of funding was invested in teams with only female founders and 13.4% to teams with at least one female founder.

Australia: Only 3% of funding went to all-women founded companies during 2022, up slightly from 2% in 2021. And there were 10% with at least one female founder, down from 21% in 2021

What About the Diversity Gap within Financial Entities..?

The Diverse Asset Managers Initiative, connecting diverse asset managers with the more traditional investing community, reveal that only 2% of all assets are managed by women or people of color. They state this isn´t a supply problem - but a demand problem.

National Association of Investment Companies, Examining the Returns 2019, show the benefits of investing with diverse asset managers and that diversity can lead to excess returns and increase the probability of investment success.

Barclays Capital report titled “Affirmative Investing: Women and Minority Owned Hedge Funds,” found that “performance, both in terms of absolute returns and risk-adjusted returns, is substantially stronger for women and minority owned hedge funds than for the hedge fund universe at large.”

The 2022 VC Human Capital Survey by Deloitte, Venture Forward and NVCA, reveal VC teams are 70% white, up to 75% when looking only at partner/equivalent. While VCs report 47% women in their teams, women only account for 26% of investment professionals, and 19% investment partner level.

The 2022 report on European Women in VC found that 85% of general partners in Europe are male - 90% in Southern/Eastern Europe. The 15% female GPs lack equal access to raise capital and manage funds, and control only 9% of the capital. 30% of female GPs are not GPs by definition as they don´t hold management company ownership or the rights to carried interest.

There are still only 32% women on senior level roles. Women are largely present within junior investment roles, with growing interest in entering VC - however they drop off before reaching partner level.

RBS Wealth Management study (April 2021), shows that female investors are taking lead in sustainable investment. Research shows that they are less driven by financial incentives, and more so by purpose, willing to accept higher risks or lower return on ESG investments

Surveyed VC firms in the 2022 VC Human Capital Survey by Deloitte (covering 315 US firms with 5.700 employees), are recognizing that more diverse, equitable, and inclusive teams outperform, fuel innovative ideas (that may have previously been overlooked), and create value. Research consistently shows that diverse teams have broader networks and are more effective at decision-making.

Less than 5% VC partners in the US are women, and 64% of VCs with above $25M under mgt. had no female founders at all.

PitchBook´s 2023 All In report reveals that among investment partners, only 19% are female, up from 16% in 2020 and 11% in 2016. Women are also far less likely to represent their VC firm on the boards of portfolio companies (20%), serve as a member of the firm’s investment committee (20%), or serve as an owner of the management company (17%).

While European research shows that 65% of VCs claim they have a DEI strategy influencing investment decisions, this does not reflect in actual investments - as female/mixed-gender-lead teams only represent 11% of VC investments.

Loading...